“Even as the crisis unfolded, we didn’t know how wide it was going to spread, or how severe it was going to be. And we were still hoping that there would be some way for us to have a shelter, and be…less battered by the storm. But it is not possible. It’s a very globalized world; the economies are all linked together”. —Lee Hsien Loong, prime minister of Singapore, speaking in Inside Job (2010).

Ruled by the Experts, Crushed by their Follies

Towards the end of Inside Job (2010) we hear the following: “They will tell us that we need them, and that what they do is too complicated for us to understand. They will tell us it won’t happen again. They will spend billions fighting reform”. However, by not trusting the in-group of appointed experts—even if you are an expert itself—you can find yourself placed in the camp of anti-intellectuals, of the dumb masses who distrust experts, who negate the authority of the wise credentialed managers. Incredulity and scepticism—basic epistemic requirements for science—are thus resentfully transformed into “post-truth” and “post-knowledge”.

“This is a temporary blip, and things will go back to normal”—this too comes from Inside Job. It is a hallmark of reality-denialism that is one of the distinctive features of the dying days of post-liberalism.

Just for provoking this sort of discussion, Inside Job continues to be a useful documentary to study.

2008: The Closing Act of the US-led Global Order?

Something very big fell with the stock markets in 2008: American empire. The US imperialist class of transnational technocrats, militarists, and corporate oligarchs dedicated their greatest efforts to propagating, justifying, and enforcing US-dominated globalization—and it was their system that was fatally wounded. When in the next century (if there is one), history texts write of the fall of the American empire, the 2008 financial crisis will be one of the decisive closing acts.

We may be reminded that, in 2008, just as the US had reached the height of its conquest and plunder of Iraq, that Iraqis fought back, and that once again it was the periphery that had forced the centre to lose its grip. Iraq was the next leg in the relay after Vietnam, and together they demarcated a 50-year downturn. At the height of this barbaric war of conquest, Americans went on a consumption frenzy, buying up homes with values far beyond what their incomes could ever justify, even if multiplied by seven. The American Dream became a lottery, an illusion of great fortunes and minimal consequences, and it was all a fraud. The desire to dream again is back once more, and this time what is inflated is the degree of political expectation.

“Inside Job” is an indictment of Globalization and Academic Expertise

What is perhaps most remarkable about Inside Job is that it was ever made to begin with, particularly by a major corporate studio such as Sony Pictures Classics, and narrated by a Hollywood celebrity like Matt Damon who agreed to speak narrative lines that were strongly critical of president Barack Obama. The film offers key images accompanying critical points that would then be echoed by none other than Donald Trump in 2016 (insincerely and hypocritically, as is his trademark). One can hear and see these echoes of Inside Job in Trump’s “closing argument” campaign ad from 2016: Goldman Sachs’ CEO, Lloyd Blankfein; Wall Street; stock market ticker displays; and, the New York Stock Exchange. Yet just a mere year later, Trump was touting himself as a globalist, and his cabinet had more people from Goldman Sachs in it than any before Trump.

More than just being made and distributed by Sony, and narrated by Matt Damon, Inside Job also won the Oscar award for best documentary movie in 2011. Yet it contains enough that one might reasonably doubt if this movie would have been made, and celebrated, to the same degree eight years later.

In the quote above, Lee Hsien Loong politely indicts institutional normalization, that spawned gullible belief in “blips,” and speaks of how globalization maximized the damage of the 2008 financial crisis. Now, upholders of the system are instead keen to defend globalization. They defend globalization against the likes of even mild offenders like Trump and Brexit. Globalization is absolved of all its sins, even by precarious part-time academic writers who no longer take notice of their precarity when their ideological father calls them to attention—the same father that brought them to their knees.

Globalization means no home, thus no shelter. Globalization not only fails to offer any immunity from mass orchestrated viral diseases, it produces the vectors for spreading those diseases. To ensure consumerist conformity, globalization involves mass regimentation on a scale never seen before. And it is a system that cannot plausibly sustain itself—the indictment of 2008 is a permanent and irreversible one.

One of the great strengths of Inside Job, perhaps owing in part to the fact that it was written by an academic (more on Charles Ferguson below), was its strong focus on academic conflict of interest and the revolving door between Wall Street and government. The two phenomena are similar and related: both involve, ultimately, a corruption of one’s position motivated by the desire to cash in on one’s authority, and at the very least both are unethical.

Regulatory capture, it is now called, where both the revolving door and conflicts of interest are based on financial interests buying up the institutions that were supposed to monitor, evaluate, rate, and regulate bankers.

Both individual academics, and universities, played a profound role in instilling and promoting the policies that came to form what we some have called “neoliberalism,” especially in the field of economics. This is contrary to the popular myth that academics reside in an Ivory Tower and have no impact on shaping or changing the real world—it is too often the case that the reverse is true, and the myth simply works as an acquittal. Had the myth been reality, much less damage would have been done, whether we are speaking of weapons of mass destruction, ideologically-driven policies creating vast inequalities, or failed development programs.

Inside Job presents numerous examples of academic complicity in creating the conditions for the 2008 financial crisis—they became “conflict of interest” personified. Nonetheless, many of them still engage in denial, which is not helped by the rubber-stamping tendency that has become the normal mode of operation across contemporary academia. The corruption of the field of economics stands out in this documentary, with economists lending their full weight to deregulation of the financial industry. This surely should serve as a warning to all academics about the pitfalls of being “relevant,” of “making a contribution,” and achieving “greater visibility” for one’s field. Academics should never argue from a position of self-interest, and they should not be vesting their interests in powerful institutions, or marshalling the aid of the powerful to shore up their professions—these ought to be the golden rules of academia.

As Inside Job informs us,

“Since the 1980s, academic economists have been major advocates of deregulation, and played powerful roles in shaping U.S. government policy. Very few of these economic experts warned about the crisis. And even after the crisis, many of them opposed reform”.

We are confronted in the film with sheer academic dishonesty, research misconduct, and academic malpractice, with economists paid by industry groups to write lying flattery and cover ups. Almost everywhere you find academic research commissioned by private corporate interests, scandal looms large.

Instead we hear John Campbell, the chair of the Economics Department at Harvard University, declare that it is “basically irrelevant” if faculty write reports without disclosing that they received payment to write them, and there is no need to disclose the conflict of interest. The same individual embarrassingly choked up when asked to defend the same practice for medical researchers writing favourable reports on a drug, with the reports paid for by the pharmaceutical company making the drug.

As we are dealing with the basic corruption of elite institutions, of expert knowledge, there is no use crying about “post-truth” and “post-knowledge” now. On the bookshelf behind Campbell are volumes with titles such as Irrational, Irrational Exuberance, and Beyond Greed and Fear, as if any further irony was needed.

Here is the relevant clip from the film, with some material left out for the sake of brevity:

Frederic Mishkin, responded in an interview in Inside Job when asked why he left his position as Governor of the Federal Reserve in August of 2008, in the middle of the worst financial crisis in history: “So, so, uh, that, uh, I had to, to revise a textbook”.

The revolving door between the US government and big business is now legendary, and is no less evident in Inside Job. We are presented with multiple cases of officials ending up with companies they benefited while in government office: Robert Rubin would leave government and later make $126 million as the vice chairman of Citigroup, which benefited immensely from the so-called Citigroup Relief Act (the Gramm-Leach-Bliley Act), which overturned the Glass-Steagall Act and thus allowed for Citibank’s expansion. In 2000, Senator Phil Gramm played “a major role in getting a bill passed that pretty much exempted derivatives from regulation,” according to the script of the film—we then hear and see Phil Gramm declare: “They [derivatives] are unifying markets, they are reducing regulatory burden”. After leaving the Senate, Gramm became Vice-Chair of UBS. His wife, Wendy, served on the board of Enron. We also learn of Alan Greenspan working as a consultant for Keating, in the run-up to the savings and loans crisis of the late 1980s. Larry Summers made $20 million as a consultant to a hedge fund that relied heavily on derivatives.

The title, Inside Job, is really the best choice for what is shown in the film, and it’s not “conspiracy theory”: it’s documented historical fact of collaboration among members of a class.

An Overview of “Inside Job”

The film opens with the stated intention of explaining how the 2008 financial crisis happened. It starts by using Iceland as kind of vignette: here was a “stable democracy,” with a “high standard of living,” being financially decimated by bank fraud that caused the collapse of Iceland’s economy. In outlining the basic components of the documentary’s explanation, the list of contributing factors focuses especially on deregulation, privatization, and financialization. In addition, audits by ratings agencies, which seemingly gave a pass to everything, are explained by the fact that up to a third of financial regulators were co-opted by the banks (for related discussion, see The China Hustle). After this opening, the documentary is presented in five parts.

Part 1: How We Got Here details the explosive growth of the US financial sector. (While financialization is discussed, we are not told how it originated, and thus nothing about the imperialist foundations for financialization.) What is shown is that there has been an increase in the succession of financial crises from the 1980s onwards—the film places primary blame on the Reagan administration. Economists, lobbyists, and Wall Street all supported Reagan and the marriage between Washington and Wall Street. Alan Greenspan, who certified the worthiness of Keating prior to the savings and loan crisis, was made the Chair of the Federal Reserve by Reagan, and was then reappointed by Clinton and G.W. Bush.

With mergers and consolidations, banks grew so large that failure of any one of them could threaten the whole system. We end up with the situation where, “by the late 1990s, derivatives were a $50 trillion unregulated market”. By the time George W. Bush took office in 2001, the US financial sector “was vastly more profitable, concentrated, and powerful than ever before”. The US financial industry was dominated by five banks: Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill Lynch, and Bear Stearns. In addition, it was dominated by two financial conglomerates: Citigroup and J.P. Morgan. Added to this list were three securities insurance companies: AIG, MBIA, and AMBAC. Finally, there were the three main rating agencies: Moody’s, Standard & Poor’s, and Fitch.

Where Part 1 really excels is in its crystal clear explanations of what are “collateralized debt obligations” (CDOs), “subprime loans,” and “credit default swaps” (CDS)—far better than the confusing mess made of these in The Big Short (which was perhaps intentional, as a way of overwhelming viewers with the bizarre, labyrinthine nature of the financial industry and its inventions).

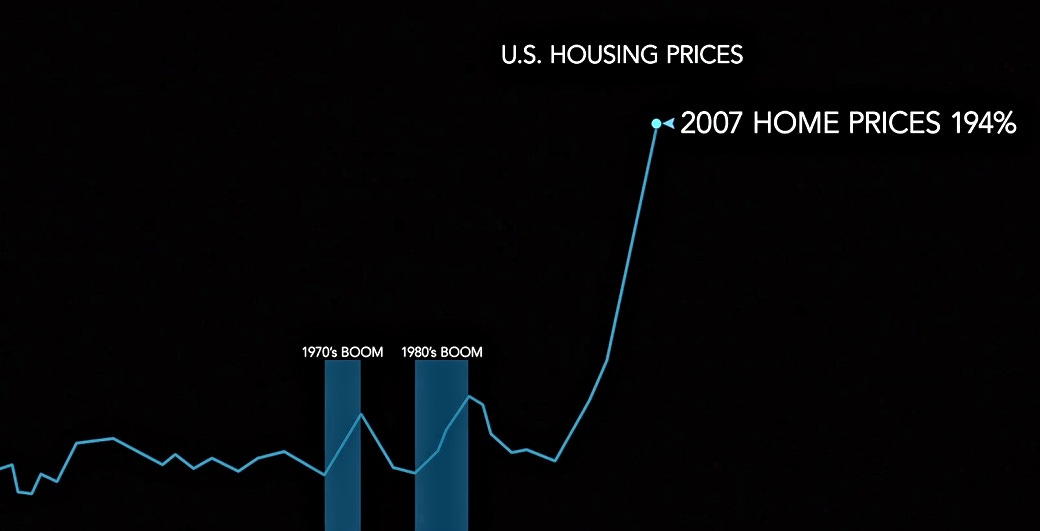

Part 2: The Bubble (2001-2007) talks of course about the inflation of the market for house mortgages: “Since anyone could get a mortgage, home purchases and housing prices skyrocketed. The result was the biggest financial bubble in history”. The film at this point comes almost to the point of casting a critical eye on naïve and greedy consumers, such as those attending a mortgage party organized by lenders (photo above): “At $500 a ticket, they’ve come to hear how to buy their very own piece of the American dream”.

What is also raised here is the power of ideology in vanquishing rational, logical, objective and disinterested analysis—a lesson for everyone, at all times, regardless of the specific ideology they may follow.

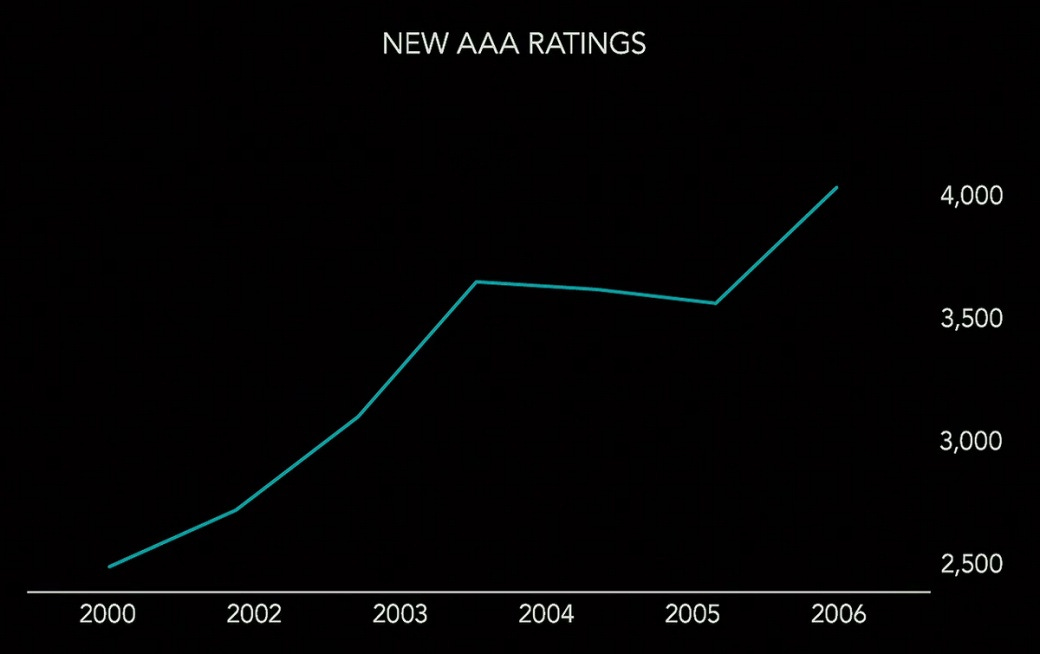

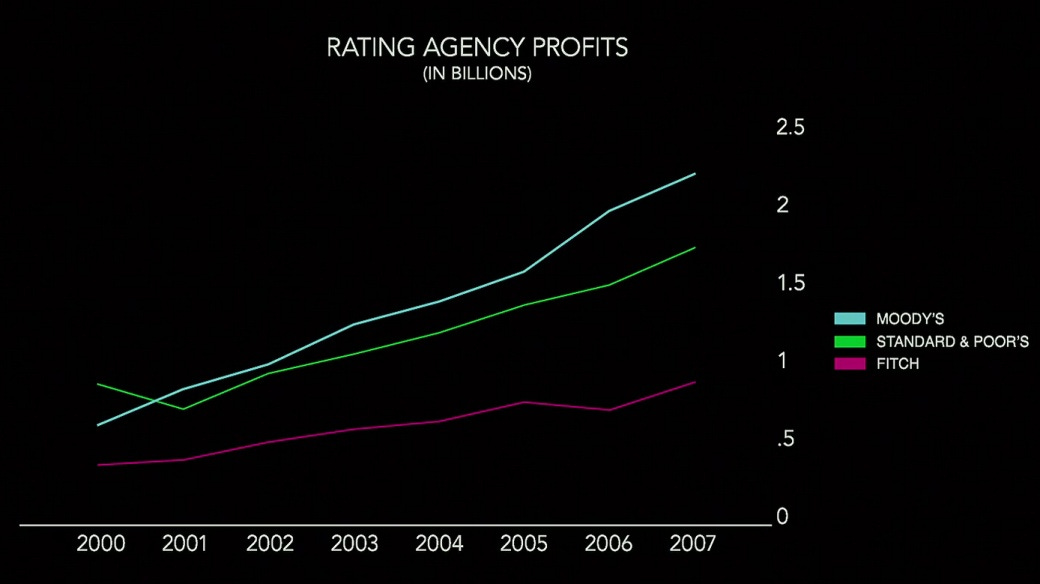

In this part of the film, Goldman Sachs appears as the major villain in this story, which even after it was revealed just how great a role it played in creating the crisis, it nonetheless retained if not increased its influence in government—that has been true almost up to the present, with former CEO Gary Cohn resigning from the Trump administration just a couple of months back. In addition to Goldman Sachs the documentary speaks of “the three rating agencies—Moody’s, S&P, and Fitch—[which] made billions of dollars giving high ratings to risky securities. Moody’s, the largest rating agency, quadrupled its profits between 2000 and 2007”. The relationship between ratings agencies’ rising profits and the increase in high ratings they gave to risky financial products, is shown in the two graphs below.

Part 3: The Crisis begins with a long list of prominent, public warnings about the epidemic in mortgage fraud, the riskiness of subprime lending, and the dangerous impact of inflated incentive structures for executives—warnings made years in advance of the actual crash. All of the warnings were ignored. This leaves us with a problem: was the attitude of ruling elites one of a denial of reality, or was it a studied ignorance? In other words, did they wilfully ignore what they knew to be true, or did they not even acknowledge the truth of conditions around them? Either way, this reality recognition/ acknowledgment problem persists, and dominates, to this day. However, this also complicates the picture we have of elites, as clearly there was some dissension among them, and some of them were quite aware and astute in analyzing current realities.

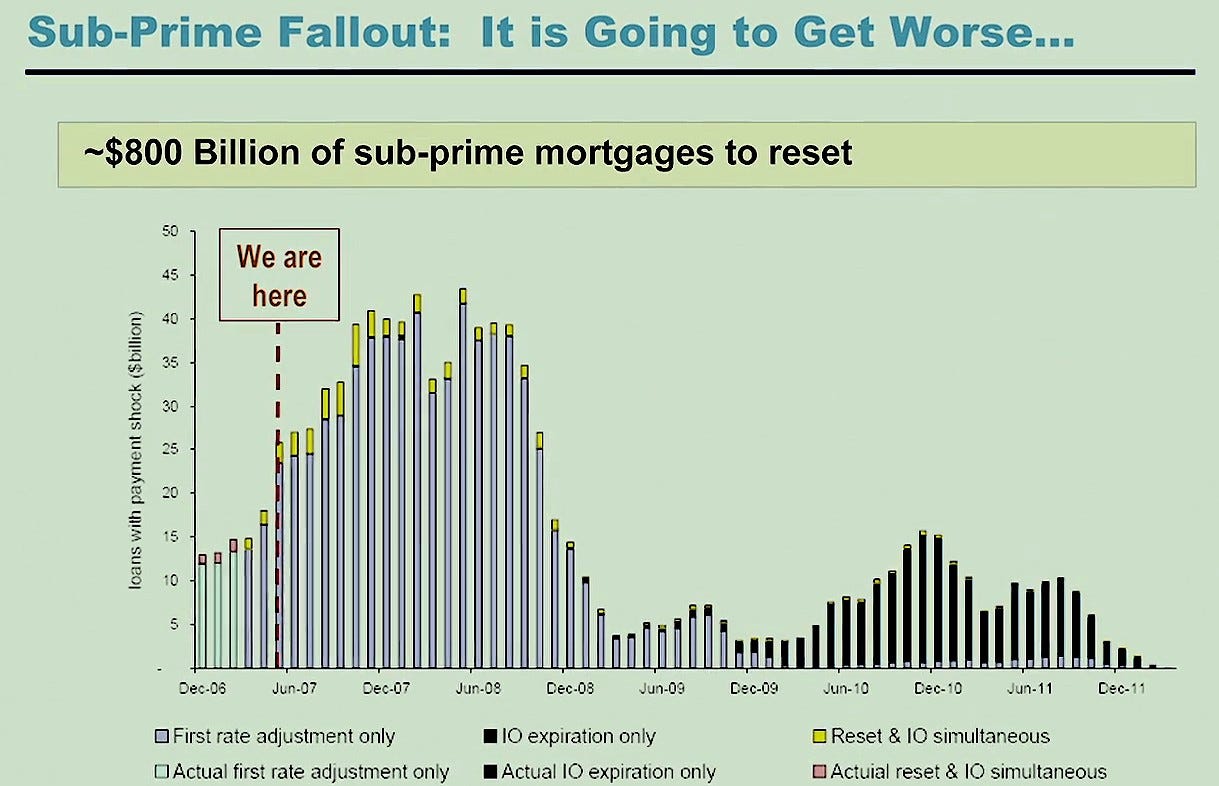

With respect to the financial crisis, the documentary reveals that, “as early as 2004, the FBI was already warning about an epidemic of mortgage fraud. They reported inflated appraisals, doctored loan documentation, and other fraudulent activity”. In 2005, the IMF’s Raghuram Rajam published a paper, “Has Financial Development Made the World Riskier?” which is accompanied by the presentation below.

In 2006, economist Nouriel Rabini warned of a crisis in his paper, “Why Central Banks Should Burst Bubbles”.

In May of 2007, hedge fund manager Bill Ackman circulated a presentation titled “Who’s Holding the Bag?” which described how the financial bubble would burst (a slide from his presentation is shown below).

Later in 2007, Allan Sloan’s article in The Washington Post, “An Unsavory Slice of Subprime,” also sounded alarms. In early 2008, Charles Morris published his book about the impending crisis: The Two Trillion Dollar Meltdown: Easy Money, High Rollers, and the Great Credit Crash. There were also repeated warnings from the IMF, aside from Rajam’s work above.

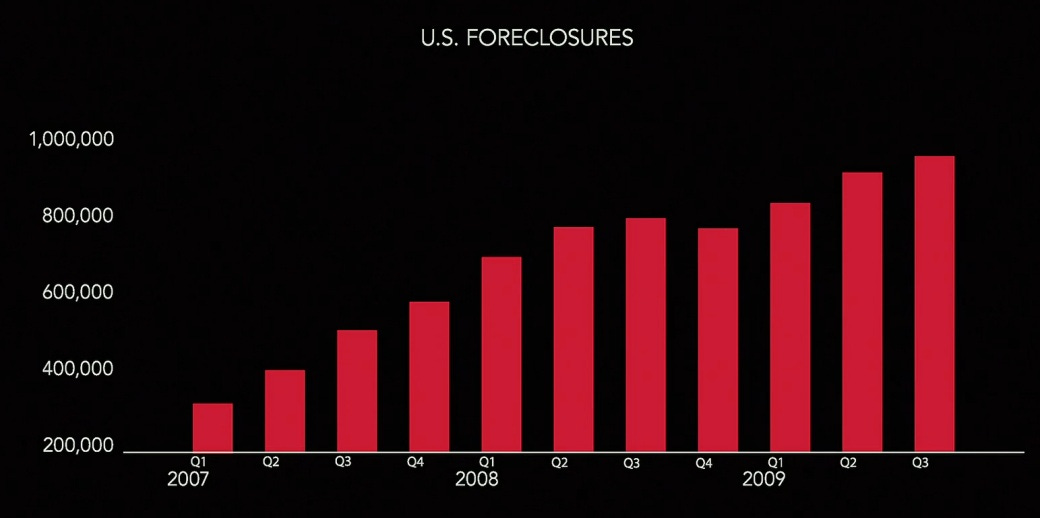

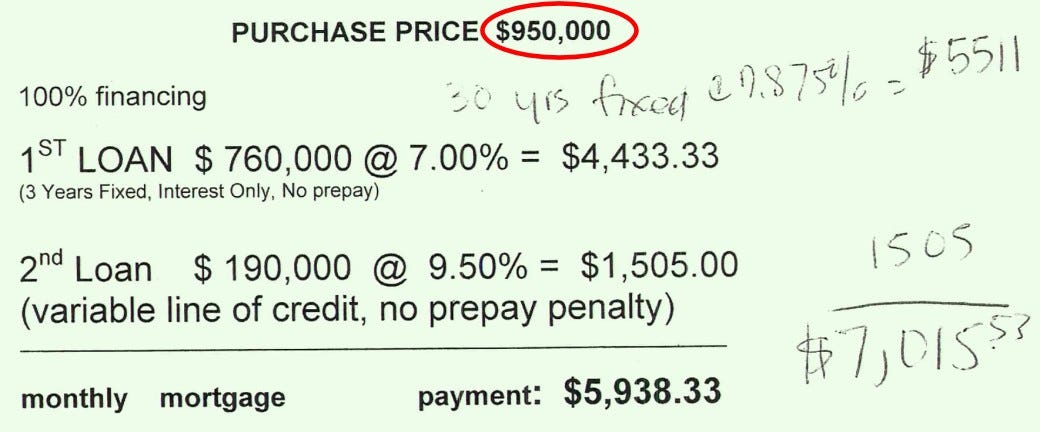

By 2008, foreclosures on houses were already skyrocketing. In the second brief instance where the film comes close to a critical commentary on consumers, we are presented with the story of Columba Ramos, speaking in Spanish. Her family immigrated from Colombia and soon after arrival fell for a fraudulent mortgage seller. They thought they had won the lottery, she says, they had hit the jackpot, the American Dream in one quick and easy step: they purchased a luxury home thinking they could make minimal payments. The film actually shows us their first payment invoice, which also reveals that they bought a home that was priced at nearly a million dollars (photo below). As Columba Ramos says: “Everything was beautiful, the house was very pretty. The payment was low. Everything was—we won the lottery. But the reality was when the first payment arrived”. What she doesn’t say is what caused them to have such unrealistic optimism that they could afford a million dollar house, shortly after arriving in the US.

Meanwhile the government, with policy shaped by former executives of Goldman Sachs, shielded Goldman Sachs specifically from any lawsuits, plus the government mandated maximum compensation (100 cents on the dollar) for Goldman Sachs’ purchase of CDOs from AIG.

The irony that some viewers might overlook is how the US’ house was in such disrepair, yet the US presumed to get other people’s houses in order around the world. The irony should have been palpable when the documentary turned into a mournful lament that echoed the famous (and famously annoying) humanitarian aid TV commercials of the “save the children” variety—with little effort one could repackage this part of Inside Job to look and sound like one of those commercials. We are shown aid workers, in tent cities (photos below), abandoned homes with overgrown lawns, and lonely, silent construction sites.

Part 4: Accountability tells us that the top executives who took a leading role in fostering the financial crisis, largely retained their wealth. Even worse was the fact that after the crisis settled, there was a greater concentration of capital and the monopoly power of banks was heightened. One of the speakers in the film, Martin Wolf, states: “There are fewer competitors, and a lot of smaller banks have been taken over by big ones. JP Morgan today is even bigger than it was before”. He is followed by Nouriel Roubini: “JP Morgan took over first Bear Stearns and then WAMU; Bank of America took over Countrywide and Merrill Lynch; Wells Fargo took over Wachovia”. With heightened monopoly power, the banks increased their lobbying power. The financial services industry lobbied harder than ever to push back against reform—and possessed more than five lobbyists for each member of Congress, and spent over $5 billion from 1998 to 2008 in lobbying and campaign contributions. The documentary states that after the crisis, they were spending even more on their lobbying campaigns. The regulations that resulted largely reflected the lobby’s interests, which is perhaps one reason why criticisms about the current rollback of those regulations amount to so many misplaced complaints that if anything whitewash the nature of those weak reforms that were produced under the influence of lobbyists.

Nevertheless, in some respects 2018 (when this review was first published) is filled with growing echoes of 2008. Recently, the pope has condemned credit default swaps, calling derivatives immoral. In this month alone (May 2018) several articles have come out warning of an “emerging market crisis” that could rival the crash of 2008. One wonders how much repetition is needed before people realize that there is a systemic problem—not simply a problem of the supposedly immoral lifestyles of select individuals. Films such as Inside Job will never venture into such discussions. The same is also true of the next film to be reviewed here: Inequality for All.

Finally, it was in this section of the film where the extent of corruption in the academic field of economics was laid out for viewers to wince at.

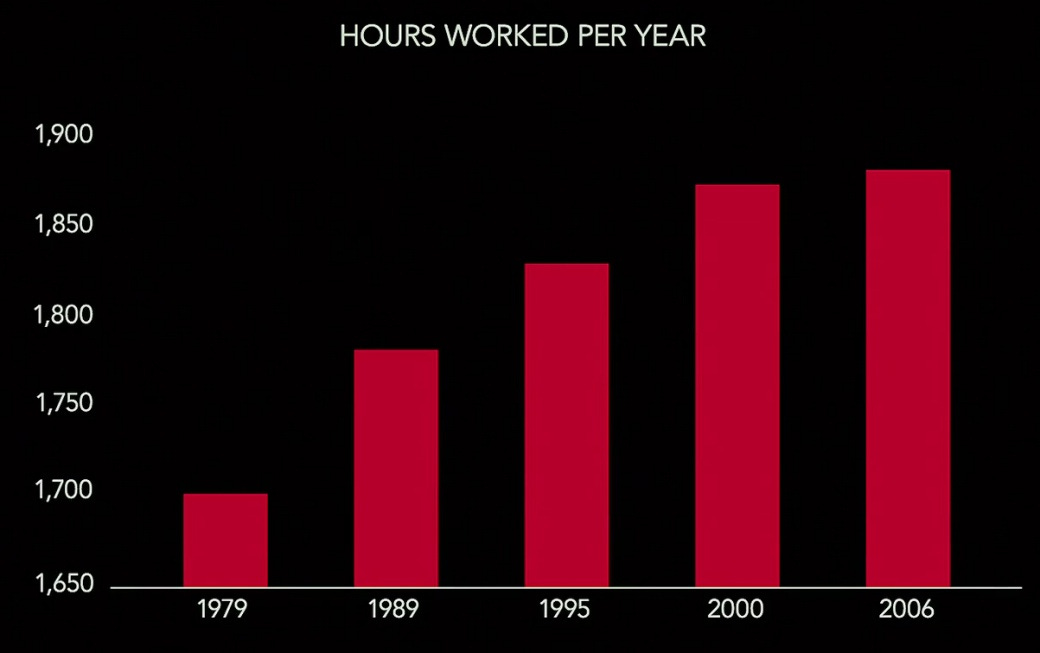

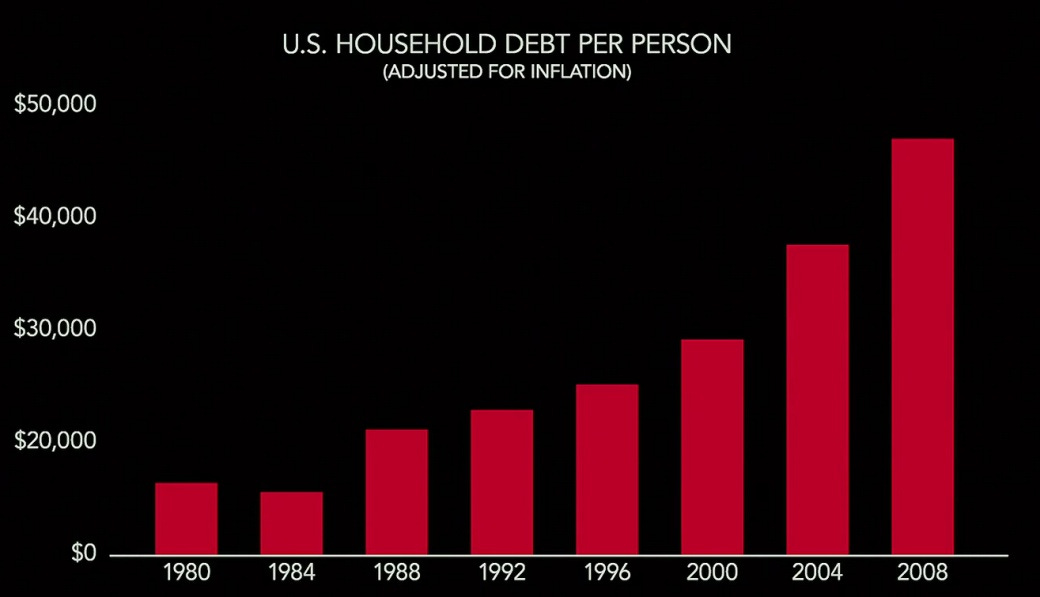

Part V: Where We Are Now is perhaps one of the more distressing parts of the documentary, but also valuable in shedding light on our current situation. Accompanying the rising power of the financial sector in the US, a “wider change in America” took place, which saw workers working longer hours (increased productivity, to historically high levels) while seeing their returns diminish and their debt increasing (see the charts below, from the film). The US has become more unequal, and the country as a whole is losing its economically dominant position.

Obama was elected with the hope that he would introduce significant changes. But, as the film emphasizes, when reforms were finally enacted in mid-2010, “the administration’s financial reforms were weak, and in some critical areas, including the rating agencies, lobbying, and compensation, nothing significant was even proposed”. Moreover, Obama chose Timothy Geithner as Treasury Secretary— Geithner was the president of the New York Federal Reserve during the crisis, “and one of the key players in the decision to pay Goldman Sachs 100 cents on the dollar for its bets against mortgages”. The film then goes on to list eight more cabinet positions and presidential advisers chosen by Obama, each with direct links to companies and decisions that led to the 2008 crisis—conflict of interest on a scale rarely seen, even in US political history:

“The new president of the New York Fed is William C. Dudley, the former chief economist of Goldman Sachs, whose paper with Glenn Hubbard praised derivatives. Geithner’s chief of staff is Mark Paterson, a former lobbyist for Goldman; and one of the senior advisors is Lewis Sachs, who oversaw Tricadia, a company heavily involved in betting against the mortgage securities it was selling. To head the Commodity Futures Trading Commission, Obama picked Gary Gensler, a former Goldman Sachs executive who had helped ban the regulation of derivatives. To run the Securities and Exchange Commission, Obama picked Mary Shapiro, the former CEO of FINRA, the investment-banking industry’s self-regulation body. Obama’s chief of staff, Rahm Emanuel, made $320,000 serving on the board of Freddie Mac. Both Martin Feldstein and Laura Tyson are members of Obama’s Economic Recovery Advisory Board. And Obama’s chief economic advisor is Larry Summers”.

Obama’s weak “reforms” were designed and supervised by those who profited from the very industry they were overseeing—and not because they were undertaking any act of penance did they enact those reforms.

While as individuals we may have little power to prevent systemic crises from repeating themselves, surely we have the power to stop placing so much credulous faith in the authorities and their experts?

The Nature of the Documentary’s Critique

Written, produced, and directed by former MIT academic and software entrepreneur Charles Ferguson, Inside Job is not a product that one could fairly and accurately critique as dogmatically partisan. For example, the script spares neither Bill Clinton nor his Republican predecessors any blame in continuing policies of deregulation, and deepening the alliance with Wall Street. The film also has the economist Nouriel Roubini explaining: “The financial sector, Wall Street being powerful; having lobbies, having lots of money; step by step…captured the political system; you know, both on the Democratic and the Republican side”. The film carries no water for Obama either, sharing none of the “hope” that had already evaporated by 2010: nothing significant changed after his election, and all Obama introduced were weak or no reforms, and no justice. The documentary script thus states that Obama’s was “a Wall Street government,” ultimately no different from that of his predecessors such as the two Bush presidents and Ronald Reagan.

What made this documentary safe for high-level distribution, promotion, recognition, and reward, is the fact that it has a basically reformist message, even if the injustices the film showed deeply angered many reviewers (judging from some of the reviews posted online). Ultimately what is presented is a call for the system to work better, not a call to revolution—but this may involve misunderstanding the core of the problem, where “greed” is a necessary part of capitalism. There is even a hint of optimism in the film: “we’ve avoided disaster and are recovering”. The filmmaker wants viewers to place their faith in gaining more knowledge of how the system works, while advocating for more legal prosecution, stronger regulation, and public pressure—meaning, working within the system, in order to save the system.

To save the system from whom, and for whom? Here the film displayed predictable establishmentarian tendencies: we need to be saved from stupid, greedy, dishonest people who lie too damn much.

The “we” who needs to be saved are the consumers, who are not faulted in the slightest in the whole film, not even for a moment. Consumers are the pure victim here. What therefore goes unexamined is the problem of consumption, where enough is never enough, where we ardently defend the doctrine of “more,” and seek constant “progress”. Also, while one of the film’s core tenets is the otherwise reasonable argument for more and better regulation, it does not envision the problem of massive regulation which usually works in favour of the biggest businesses and thus becomes an anti-competition device that supports monopoly. With some regulations amounting to tens of thousands of pages, it takes a company a large legal department to properly follow and implement those regulations, which small businesses cannot afford.

While Democrat donor George Soros (a financial crasher in his own right) is also approvingly featured in the film as a voice of wise counsel, he had no role in either producing or funding it, and is not thanked in the closing credits of the documentary. This does not mean that the filmmaker does not betray certain other peculiar international political stances—for example, we are told that, “Credit Suisse helped funnel money for Iran’s nuclear program, and for the Aerospace Industries Organization of Iran, which builds ballistic missiles,” and this is cited as an example of “corrupt practices” in the banking industry. The taken for granted assumption here is that Iran has no legitimate right to nuclear energy, and no legitimate right to defend itself—to assist Iran in exercising its sovereignty is “corruption”.

The documentary’s narrative takes a predictably American angle to explaining American actions, focusing heavily on a moralistic critique of individual, personal flaws. Thus a fair amount of time is spent on issues such as the lifestyle of bankers, their cocaine use and frequent visits with prostitutes, their lavish spending, their dishonesty, and lack of disclosure. What is the crime here? Is it rich people spending money on themselves? The film maintains the illusion that one can have a fiscally austere, morally upright, and ethically righteous capitalism. By personalizing its message and spinning a standard morality tale, what is preserved is the mythology of liberal capitalism with its hero legends of courageous investors, tales of rational capitalists, and not too far behind that, the creation story featuring noble pioneers with their Calvinist work ethic. The problem, therefore, is not with the system or its ruling doctrine, it’s with some people. Moralism facilitates reformism—but here Charles Ferguson has a problem in that many among his audience are considerably more sceptical and critical than he is, something that shows up in this interview he gave with audience members on PBS. Note the defensive nature of many of his replies.

However, the film was still a surprising and rare exception for Hollywood. Unusually sober and critical, it tries to avoid kicking too much sand into the eyes of its viewers. There has been a short string of relatively good Hollywood films, both fictional and not, with a definite anti-“neoliberal” message and a close correspondence with Inside Job, with those that come immediately to mind being: “Arbitrage” (2012), “Assault on Wall Street” (2013), “99 Homes” (2014), and “The Big Short” (2015). The latter goes very well with Inside Job as the two films tend to mutually reinforce, explain, and illustrate each other.

The film is still relevant today and should be shown in courses dealing with globalization; I am thus scoring it as 8.5/10.

References and Further Reading:

Kakutani, Michiko. (2008). “Why Knowledge and Logic Are Political Dirty Words”. The New York Times, March 11.

Kakutani, Michiko. (2017). “‘The Death of Expertise’ Explores How Ignorance Became a Virtue”. The New York Times, March 21.

Lasch, Christopher. (1995). The Revolt of the Elites and the Betrayal of Democracy. New York: W.W. Norton & Company, Inc.

Lattman, Peter. (2011). “‘Inside Job’ Wins Oscar”. The New York Times, February 28.

Solman, Paul. (2011). “‘Inside Job’: An Oscar Winner Answers Your Questions”. PBS News Hour, May 11.